|

|

|

|||||||

| Politics & Religion Discussion of politics and religion |

|

|

|

Share | Thread Tools | Search this Thread |

|

|

#1 | |||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

Get ready FOR ROUND TWO !!!

Hold on to your hat's boys, it's gonna be another WILD ride. Holder Launches Witch Hunt Against Biased Banks Quote:

|

|||||||

|

|

|

|||||||

|

|

#2 | |||||||

|

Barn Stall Owner #66

Join Date: Nov 2009

Location: PLANO, TEXAS

Posts: 723

Thanks: 57

Thanked 162 Times in 95 Posts

Gameroom Barn Bucks: $4290

|

Shoot Will,

What could be better than BHO and his idiot minions implementing round two of no job, no income, no problem than once these people are in the home the US taxpayer (via FHA) is allowed to live in the home, rent and payment free, for a year or so? So they did. Quote:

Last edited by AC54ME; 07-09-2011 at 10:37am. |

|||||||

|

|

|

|||||||

|

|

#3 | ||||||

|

A Real Barner

Join Date: Jan 2011

Location: Green Acres is the place to be...

Posts: 37,317

Thanks: 6,301

Thanked 23,332 Times in 10,550 Posts

Gameroom Barn Bucks: $8122190

|

this racist administration has got to go.

anyone who supports this president & his administration of thugs are anti-American...anti-capatilsm...anti-business, and themselves are a POS in my book...and can eat shit & die. and some of them are right here on this forum. How's that Will? I didn't call out anyone by name.

|

||||||

|

|

|

||||||

|

|

#4 | ||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

|

||||||

|

|

|

||||||

|

|

#5 | ||||||

|

A Real Barner

Join Date: May 2011

Location: So Cal

Posts: 1,385

Thanks: 65

Thanked 118 Times in 89 Posts

Gameroom Barn Bucks: $15232322

|

But, but, but, owning a home in the US is a right.

|

||||||

|

|

|

||||||

|

|

#6 | ||||||

|

Barn Stall Owner #63

Join Date: Jan 2011

Location: Harrisburg/Columbia, Mo

Posts: 1,586

Thanks: 110

Thanked 290 Times in 187 Posts

Gameroom Barn Bucks: $32270

|

Hell they also have a new program for FHA that allows you to skip your payments for a year.

The catch The lending institution still gets paid, so guess who gets to pay it? |

||||||

|

|

|

||||||

|

|

#7 | ||||||

|

Vette Barn Crew

Join Date: Jan 2011

Location: Irvine Ca

Posts: 141

Thanks: 1

Thanked 17 Times in 13 Posts

Gameroom Barn Bucks: $1215

|

The Dems will be along shortly to explain how Holder and Obumble inherited this mess from GWB and the evil Pubs..

Where is KenHorse with that housing bubble post??? |

||||||

|

|

|

||||||

|

|

#8 | ||||||

|

Latin American Goat Roper

Barn Stall Owner #101 Bantayan Kids '13

Join Date: Nov 2009

Location: Orange Park Florida

Posts: 60,687

Thanks: 32,879

Thanked 11,552 Times in 5,695 Posts

Gameroom Barn Bucks: $1138393

|

There, fixed it 4 U......which is why most of the homes look like shacks inside in a very short time span.... believe me when I say....Lars builds them and I REbuild them..... U B ASStounded what any section 8 can do to a decent/nice house.....

|

||||||

|

|

|

||||||

|

|

#9 | ||||||

|

10cm member

Barn Stall Owner #90125 NCM Supporter '19,'20

Join Date: Jan 2011

Location: Houston, Tejas, Estados Unidos

Posts: 81,496

Thanks: 36,947

Thanked 41,264 Times in 17,158 Posts

Gameroom Barn Bucks: $2621492

|

|

||||||

|

|

|

||||||

|

|

#10 | |||||||

|

Barn Stall Owner #10

Join Date: Mar 2010

Location: Florida Keys

Posts: 6,625

Thanks: 363

Thanked 1,765 Times in 758 Posts

Gameroom Barn Bucks: $8563902

|

Quote:

Even when the banks went tits up what happened? American socialism (Its only for the corporations and wealthy). |

|||||||

|

|

|

|||||||

|

|

#11 | ||||||

|

Guest

Join Date: May 2011

Location: America's Herpe (Miami, FL)

Posts: 10,963

Thanks: 8,669

Thanked 1,474 Times in 666 Posts

Gameroom Barn Bucks: $3810387

|

|

||||||

|

|

|

||||||

|

|

#12 | |||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

Quote:

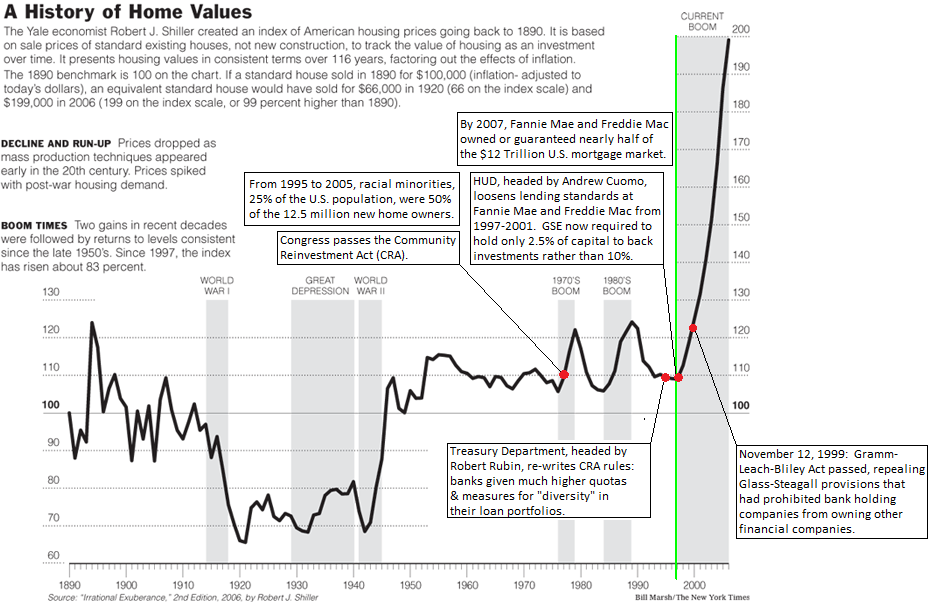

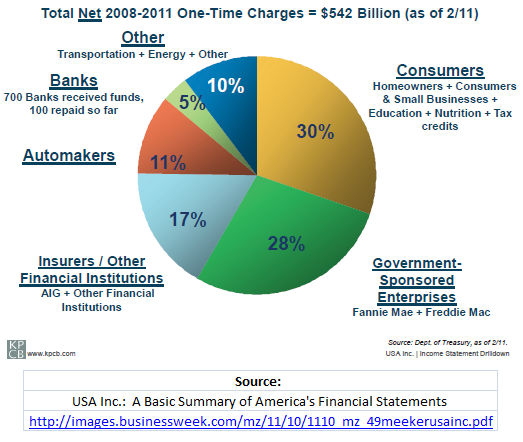

I'm not defending all these horse-crap corporate bailouts that NEVER should have happened, BUT....  Due to REPAYMENT by large corporations, the misnomer about bailouts helping wall street and not "main street" is just that - a misnomer. The banks, financial firms, and auto-makers account for just under 1/3 of the NET one-time charges. Fannie and Freddie, which existed essentially to give home loans to the some of the Democrat's strongest voting blocks, the lower income and racial minorities, account for 28% of the NET. And they did, in fact, succeed in their objective. The fact that racial minorities, who make up only 25% of our population AND still enjoy much lower average and median income than whites, accounted for 50% of all new home owners over the course of the bubble shows how "successful" they were. It was a fraud, and Fannie/Freddie needed bailing out, so essentially those new home owners were recipients of TARP funds, just after the fact, since they never would have been homeowners otherwise. Another 30% of the NET one-time charges were things like tax credits and refundable tax credits, the mortgage help programs, aid to small businesses, etc. |

|||||||

|

|

|

|||||||

|

|

#13 | ||||||

|

A Real Barner

Join Date: Jan 2011

Location: Green Acres is the place to be...

Posts: 37,317

Thanks: 6,301

Thanked 23,332 Times in 10,550 Posts

Gameroom Barn Bucks: $8122190

|

|

||||||

|

|

|

||||||

|

|

#14 | ||||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

Quote:

Quote:

Remember folks: -Stay on Topic -Respond coherently -Disagree respectfully |

||||||||

|

|

|

||||||||

|

|

#15 | ||||||

|

A Real Barner

Join Date: Jan 2011

Location: Green Acres is the place to be...

Posts: 37,317

Thanks: 6,301

Thanked 23,332 Times in 10,550 Posts

Gameroom Barn Bucks: $8122190

|

WTF? Will...

is your post aimed at mine? |

||||||

|

|

|

||||||

|

|

#16 | ||||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

Yes. I ASSUMED you merely made a TYPO and changed "Joefoool" to Joecoool. I re-posted what I did IN CASE OF THE SLIM CHANCE THAT IT WAS NOT A TYPO ON YOUR PART: Quote:

Quote:

|

||||||||

|

|

|

||||||||

|

|

#17 | ||||||

|

A Real Barner

Join Date: Jan 2011

Location: Green Acres is the place to be...

Posts: 37,317

Thanks: 6,301

Thanked 23,332 Times in 10,550 Posts

Gameroom Barn Bucks: $8122190

|

|

||||||

|

|

|

||||||

|

|

#18 | |||||||

|

Barn Stall Owner #66

Join Date: Nov 2009

Location: PLANO, TEXAS

Posts: 723

Thanks: 57

Thanked 162 Times in 95 Posts

Gameroom Barn Bucks: $4290

|

Quote:

To add fuel to the fire; Most still have not realized the ~$1 trillion 'stimulus' was money taken from the economy, and reinserted (by government) into the 'economy' (a falsehood as seen from your pie chart). The actual affect of such an idiotic move on the part of the government - net ZERO gain to the economy. Keynesian moves that have failed each time tried - and still the Democrats hold to them - why? IMO, because fools and Progressives cannot seem to grasp simple economic concepts, and their governing mantra is to place more wealth onto and into failed policies they set up (I.e., no job, no income, no problem housing [ NJ, NI, NP]). Overall, 50% of the 'stimulus' was additional monies paid to offset a majority of NJ, NI, NP. Kind of like alimony - the screwing you get for the screwing you got - with no ongoing benefits. And the screwing keeps on going - it is not stopped with the stimulus. FHA continues to 'pay' for owners that do no make house payments (1 year effective Aug 1), AIG, the two Fannies are but minimal examples. Of course there is the other screwing of the taxpayer - states. Those that took money to pay for UE payments are now stuck with the continuing bill, those that took money for state expenditures (I.e., teacher, police, firefighter, etc.) 'retention' are now paying the tab on their own. All on the backs of the taxpayer. All funded with debt. All reducing the recovery/expansion of the US economy. In the future it is inevitable that many books will be authored on this matter - showing the complete idiocy of the policies and negative affects. In fact there are a few already on bookshelves. The sad news - many were written decades ago. But the Progressives and politicians in general never read them - they were not on the required reading list on how NOT to destroy an economy. |

|||||||

|

|

|

|||||||

|

|

#19 | ||||||

|

Barn Stall Owner #63

Join Date: Jan 2011

Location: Harrisburg/Columbia, Mo

Posts: 1,586

Thanks: 110

Thanked 290 Times in 187 Posts

Gameroom Barn Bucks: $32270

|

|

||||||

|

|

|

||||||

|

|

#20 | ||||||

|

A Real Barner

Join Date: Jan 2011

Location: Green Acres is the place to be...

Posts: 37,317

Thanks: 6,301

Thanked 23,332 Times in 10,550 Posts

Gameroom Barn Bucks: $8122190

|

|

||||||

|

|

|

||||||

|

| Thread Tools | Search this Thread |

|

|

Support the Barn: |

Download the Mobile App; |

Follow us on Facebook: |

||