|

|

|

|||||||

| Politics & Religion Discussion of politics and religion |

|

|

|

Share | Thread Tools | Search this Thread |

|

|

#1 | |||||||||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

Oy vey.

Updated Prediction based on my model:  Some background for those that weren't around when I started doing this: Quote:

Just a refresher, the historical basis of our calculations and mapping: Quote:

My VERY FIRST prediction from April 2009 based on my Model: Quote:

|

|||||||||||||

|

|

|

|||||||||||||

|

|

#2 | ||||||

|

Barn Stall Owner #6

Bantayan Kids '13,'14,'15,'17

Join Date: Jan 2011

Posts: 6,541

Thanks: 904

Thanked 1,484 Times in 828 Posts

Gameroom Barn Bucks: $437465

|

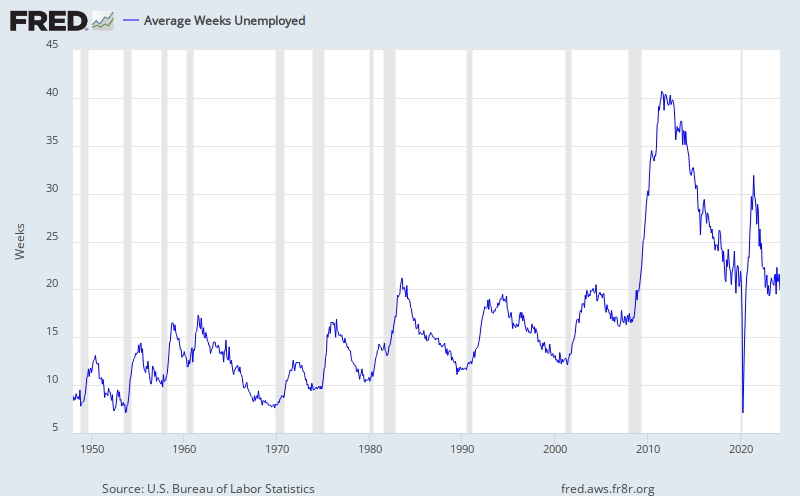

Labor Force Participation Rate Drops To Fresh 25 Year Low: 64.1% | zero hedge Employment Situation Summary Table A. Household data, seasonally adjusted The number of people that have dropped out of the labor force is keeping that unemployment number artificially low...not to mention the under employed. |

||||||

|

|

|

||||||

|

|

#3 | ||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

WOW.

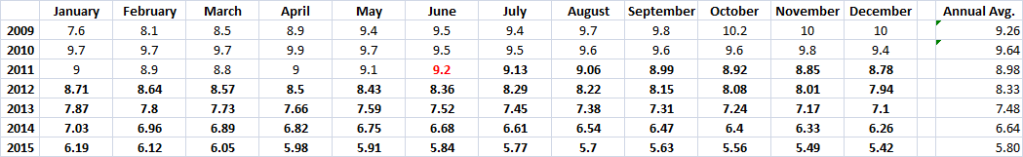

In January 1984, the unemployment rate was at 8% and in the middle of a FREE-FALL. Three months earlier it was 8.8%, and 3 months later it was 7.7%. Today, with roughly the same low labor force participation rate, unemployment is at 9.2% and in the middle of a RISE. 3 months ago it was 8.8%

|

||||||

|

|

|

||||||

|

|

#4 | |||||||

|

Barn Stall Owner #66

Join Date: Nov 2009

Location: PLANO, TEXAS

Posts: 723

Thanks: 57

Thanked 162 Times in 95 Posts

Gameroom Barn Bucks: $4290

|

Quote:

Will - if the number of people 'discouraged' and no longer seeking employment, and those that took 'early retirement' in the past three years were incorporated in your analysis the actual percentage INCREASE over the next 18 months would seem to be enormous vs the present numbers. What is the chance that you can project those? |

|||||||

|

|

|

|||||||

|

|

#5 | |||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

Quote:

Maybe I'll try to figure it out this weekend. I might post here asking for help. Honestly, if you read the description and remember this from when it started a few years ago on the OTHER forum, this was a VERY crude best-case scenario model I threw together. Unemployment is not my area of expertise.

|

|||||||

|

|

|

|||||||

|

|

#6 | |||||||

|

Barn Stall Owner #66

Join Date: Nov 2009

Location: PLANO, TEXAS

Posts: 723

Thanks: 57

Thanked 162 Times in 95 Posts

Gameroom Barn Bucks: $4290

|

Quote:

|

|||||||

|

|

|

|||||||

|

|

#7 | ||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

|

||||||

|

|

|

||||||

|

|

#8 | |||||||

|

C4 Mod

Barn Raising II,III

Join Date: Jan 2011

Location: Cincinnati, OH ....ΜΟΛΩΝ ΛΑBE....

Posts: 13,825

Thanks: 1,307

Thanked 7,727 Times in 3,437 Posts

Gameroom Barn Bucks: $19752494

|

Was just about to make a similar thread...

Quote:

|

|||||||

|

|

|

|||||||

|

|

#9 | |||||||

|

Barn Stall Owner #66

Join Date: Nov 2009

Location: PLANO, TEXAS

Posts: 723

Thanks: 57

Thanked 162 Times in 95 Posts

Gameroom Barn Bucks: $4290

|

Quote:

It indicates that existing, PUBLISHED, numbers would be retained. The PUBLISHED numbers are low (incorrect - see Chris' chart above) - thus a 3% economic growth rate/year would not be correct in retaining existing UE percentages. It would seem that the UE percentage would increase, somewhat expanded and incrementally/proportionately, with 3% if realistic numbers were used. IMO. |

|||||||

|

|

|

|||||||

|

|

#10 | ||||||

|

A Real Barner

Join Date: Nov 2009

Location: Pronouns: Screw/You

Posts: 4,307

Thanks: 1,642

Thanked 2,418 Times in 934 Posts

Gameroom Barn Bucks: $1013854

|

Our fearless leader really needs to have an epiphany and understand that you cannot encourage job creation by purposely demonizing the job creators and threatening to tax the bejezus out of them. Who in their right mind is willing to take risks in this environment?

On the consumer end, our problem is simply a lack of confidence. Confidence in the economy and confidence in our leadership. Maybe 2012. It ain't happening with this nincompoop anytime soon. Mofo needs to go and Jan 2013 cannot get here fast enough. We are in the era of malicious ignorance and neglect in the WH. Fore!!! |

||||||

|

|

|

||||||

|

|

#11 | ||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

|

||||||

|

|

|

||||||

|

|

#12 | ||||||

|

A Real Barner

Join Date: May 2011

Location: So Cal

Posts: 1,385

Thanks: 65

Thanked 118 Times in 89 Posts

Gameroom Barn Bucks: $15232322

|

Prolly hit 10% after another Recovery Summer.

|

||||||

|

|

|

||||||

|

|

#13 | ||||||

|

A Real Barner

Join Date: Jan 2011

Location: Green Acres is the place to be...

Posts: 37,215

Thanks: 6,287

Thanked 23,251 Times in 10,515 Posts

Gameroom Barn Bucks: $8122190

|

|

||||||

|

|

|

||||||

|

|

#14 | ||||||

|

A Real Barner

Join Date: May 2011

Location: So Cal

Posts: 1,385

Thanks: 65

Thanked 118 Times in 89 Posts

Gameroom Barn Bucks: $15232322

|

|

||||||

|

|

|

||||||

|

|

#15 | ||||||

|

A Real Barner

Join Date: Jan 2011

Location: Green Acres is the place to be...

Posts: 37,215

Thanks: 6,287

Thanked 23,251 Times in 10,515 Posts

Gameroom Barn Bucks: $8122190

|

|

||||||

|

|

|

||||||

|

|

#16 | ||||||

|

Charter Member

Barn Stall Owner #58

Join Date: Oct 2009

Location: Converse, Texas

Posts: 2,776

Thanks: 206

Thanked 214 Times in 175 Posts

Gameroom Barn Bucks: $13154

|

It is even slowing down in this part of Texas and the stimulus really worked with those shovel ready jobs. Seems America is in the great depression 2 and our POTOUS has no clue as a community organizer. In 2008 America fell for hope and change, the path we are on their will not be any change left soon.

|

||||||

|

|

|

||||||

|

|

#17 | |||||||

|

Barn Stall Owner #10

Join Date: Mar 2010

Location: Florida Keys

Posts: 6,625

Thanks: 363

Thanked 1,765 Times in 758 Posts

Gameroom Barn Bucks: $8563902

|

Quote:

So many of you can't wait to vote in the next GWB... |

|||||||

|

|

|

|||||||

|

|

#18 | |||||||

|

C4 Mod

Barn Raising II,III

Join Date: Jan 2011

Location: Cincinnati, OH ....ΜΟΛΩΝ ΛΑBE....

Posts: 13,825

Thanks: 1,307

Thanked 7,727 Times in 3,437 Posts

Gameroom Barn Bucks: $19752494

|

Quote:

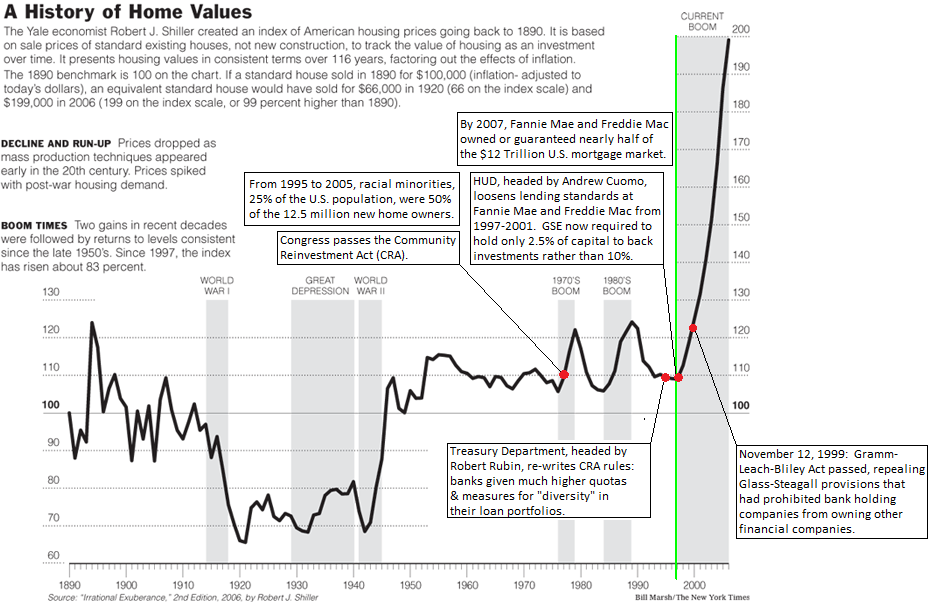

What events in early 2009 could have possibly caused this historic and never before seen split between the US and Canada? Hmmmmmm.... You can say it started under GWB and won't get many who disagree. And you need to understand that instead of recognizing economic trends, the current idiots decided to throw a gazillion dollars (that we didn't have) at it and made it even worse.   Obama has had well more than half of a Presidential term, 2 years of which was with a Democratic controlled House AND Senate. The Democrats had plenty of time to make a difference. Unfortunately the only difference that they have made is for the worse. The "let's blame Bush" shit is well past it's expiration date. But hey, who am I to argue. If it makes you feel better... keep on telling yourself it's all Bush's fault. |

|||||||

|

|

|

|||||||

|

|

#19 | ||||||

|

Charter Member

Barn Stall Owner #58

Join Date: Oct 2009

Location: Converse, Texas

Posts: 2,776

Thanks: 206

Thanked 214 Times in 175 Posts

Gameroom Barn Bucks: $13154

|

Community Organizer has lost jobs in his first 2+ years in office and his admin says we have been out of the downturn since 09

|

||||||

|

|

|

||||||

|

|

#20 | ||||||||

|

Barn Stall Owner #15

Fantasy Football Champ '11,'13,'17

Join Date: Jan 2011

Location: Somewhere between mild insanity and complete psychosis.

Posts: 7,972

Thanks: 319

Thanked 2,447 Times in 1,241 Posts

Gameroom Barn Bucks: $1050381

|

Quote:

Bill Clinton, Robert Rubin, Andrew Cuomo, Janet Reno, et al. are the most responsible "public servants"  The Bush admin even tried to do something about. Granted, he also went ahead and ran for reelection in 2004 taking credit for the increased minority home ownership. But that lie doesn't change the fact that the Clinton admin put the policies in place that started the bubble, and congressional democrats blocked every one of over a dozen attempts at reform in committee during GWB's presidency. And now? Now the idiotic administration in place is trying TO START IT ALL OVER AGAIN. Holder Launches Witch Hunt Against Biased Banks Quote:

|

||||||||

|

|

|

||||||||

|

| Thread Tools | Search this Thread |

|

|

Support the Barn: |

Download the Mobile App; |

Follow us on Facebook: |

||