|

|

|

|||||||

| Off Topic Off Topic - General non-Corvette related discussion. |

|

|

|

Share | Thread Tools | Search this Thread |

|

|

#1 | |||||||

|

Barn Stall Owner #123

Join Date: Jul 2011

Location: I live my life by 2 rules. 1) Never share everything you know. 2)

Posts: 2,187

Thanks: 153

Thanked 2,293 Times in 1,037 Posts

Gameroom Barn Bucks: $525

|

Because it worked out so well the last time.....

https://www.wnd.com/2024/06/bidens-r...ert-6-9-2024-2 Quote:

|

|||||||

|

|

|

|||||||

|

|

#2 | ||||||

|

Vette Barn Crew

Join Date: May 2012

Location: Ca

Posts: 861

Thanks: 0

Thanked 1,124 Times in 497 Posts

Gameroom Barn Bucks: $120

|

Of the 50 years in public office, he has 100% proven that he is a complete fuck up.

|

||||||

|

|

|

||||||

| The Following 4 Users Say Thank You to Swany00 For This Useful Post: |

|

|

#3 | ||||||

|

Barn Stall Owner #123

Join Date: Jul 2011

Location: I live my life by 2 rules. 1) Never share everything you know. 2)

Posts: 2,187

Thanks: 153

Thanked 2,293 Times in 1,037 Posts

Gameroom Barn Bucks: $525

|

Oops, meant this to be in P&R. Could a Mod move it please?

|

||||||

|

|

|

||||||

|

|

#4 | ||||||

|

Barn Stall Owner #123

Join Date: Jul 2011

Location: I live my life by 2 rules. 1) Never share everything you know. 2)

Posts: 2,187

Thanks: 153

Thanked 2,293 Times in 1,037 Posts

Gameroom Barn Bucks: $525

|

|

||||||

|

|

|

||||||

| The Following 4 Users Say Thank You to KenHorse For This Useful Post: |

|

|

#5 | ||||||

|

Vette Barn Crew

|

|

||||||

|

|

|

||||||

| The Following 2 Users Say Thank You to DDSLT5 For This Useful Post: |

|

|

#6 | ||||||

|

10cm member

Barn Stall Owner #90125 NCM Supporter '19,'20

Join Date: Jan 2011

Location: Houston, Tejas, Estados Unidos

Posts: 84,042

Thanks: 38,461

Thanked 42,303 Times in 17,624 Posts

Gameroom Barn Bucks: $2621492

|

Probably better off here, where it will get more traffic, and thus, more participation. It's an important topic.

Housing IS seemingly in a bubble, aided by horrific government policy combined with institutional buyers like Blackrock scooping up single family homes. It would be nice if housing, and, well, everything, would level out and be more realistically priced, but I hope we don't have to have another 2008/9 housing crash to do that. Rated thread 5 stars. Would read again. |

||||||

|

|

|

||||||

|

|

#7 | ||||||

|

Barn Stall Owner #112

Join Date: Apr 2022

Location: The Blue Ridge Mountains

Posts: 18,082

Thanks: 7,174

Thanked 4,982 Times in 2,929 Posts

Gameroom Barn Bucks: $500

|

I'm poised to take full advantage of this next housing crash.

|

||||||

|

|

|

||||||

|

|

#8 | ||||||

|

Barn Stall Owner #123

Join Date: Jul 2011

Location: I live my life by 2 rules. 1) Never share everything you know. 2)

Posts: 2,187

Thanks: 153

Thanked 2,293 Times in 1,037 Posts

Gameroom Barn Bucks: $525

|

|

||||||

|

|

|

||||||

|

|

#9 | ||||||

|

A Real Barner

Join Date: Jan 2011

Location: Green Acres is the place to be...

Posts: 38,940

Thanks: 6,595

Thanked 24,698 Times in 11,220 Posts

Gameroom Barn Bucks: $8122190

|

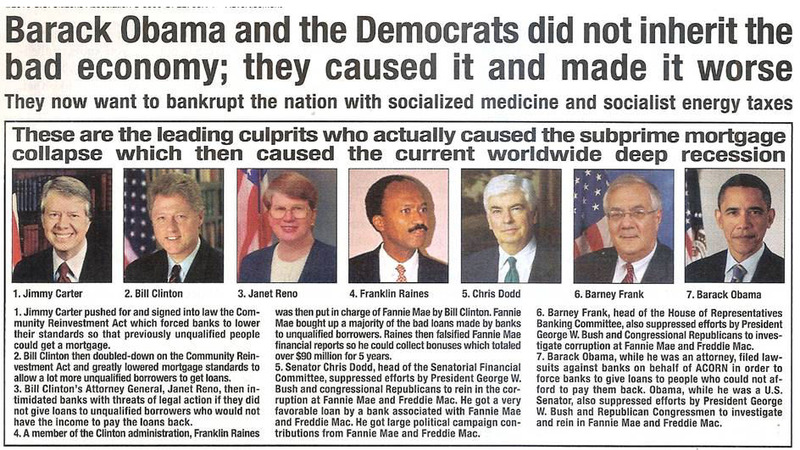

Democrats caused the last real estate/mortgage meltdown. And given the opportunity they will again.

|

||||||

|

|

|

||||||

|

|

#10 | ||||||

|

Barn Stall Owner #123

Join Date: Jul 2011

Location: I live my life by 2 rules. 1) Never share everything you know. 2)

Posts: 2,187

Thanks: 153

Thanked 2,293 Times in 1,037 Posts

Gameroom Barn Bucks: $525

|

|

||||||

|

|

|

||||||

|

|

#11 | ||||||

|

A Real Barner

Join Date: Jan 2011

Location: Green Acres is the place to be...

Posts: 38,940

Thanks: 6,595

Thanked 24,698 Times in 11,220 Posts

Gameroom Barn Bucks: $8122190

|

|

||||||

|

|

|

||||||

|

|

#12 | |||||||

|

10cm member

Barn Stall Owner #90125 NCM Supporter '19,'20

Join Date: Jan 2011

Location: Houston, Tejas, Estados Unidos

Posts: 84,042

Thanks: 38,461

Thanked 42,303 Times in 17,624 Posts

Gameroom Barn Bucks: $2621492

|

Quote:

People whose main qualification for loans was they could steam up a mirror were getting loans on multi-hundred thousand dollar houses everyone knew up front they couldn't afford. I will agree the Dems were happy to go along with all that, though. The crash was a uniparty failure. |

|||||||

|

|

|

|||||||

|

|

#13 | |||||||||||

|

Barn Stall Owner #123

Join Date: Jul 2011

Location: I live my life by 2 rules. 1) Never share everything you know. 2)

Posts: 2,187

Thanks: 153

Thanked 2,293 Times in 1,037 Posts

Gameroom Barn Bucks: $525

|

Quote:

FACT: Liberal Public Policy caused the mortgage crisis by mandating eased requirements for lending, even to people who had no chance of ever paying the loan back. If banks and other lending institutions did not comply, their "score" from the SEC was too low to permit certain business transactions such as merges, etc. This is nothing less than a gun held to the head. FACT: Many lending institutions were sued or otherwise pressured by ACORN, forcing them to make loans to folks who didn't qualify nor had any chance of ever repaying that loan. FACT: HUD (Housing and Urban Development) under Andrew Cuomo, head of HUD) browbeat banks to make loans to folks who they knew couldn't pay them back. FACT: Many lending institutions were sued or otherwise pressured by ACORN, forcing them to make loans to folks who didn't qualify nor had any chance of ever repaying that loan. IN FACT, BARACK OBAMA WAS INVOLVED IN AT LEAST ONE OF THESE LAWSUITS FACT: Fannie Mae's sole purpose for being was to offer a Federal Guarantee of loans. So banks and other lending institutions didn't need to worry about thing. If a loan went bad, Fannie Mae was there to pick up the pieces (until there were too many pieces to pick up) FACT: The Democrats stacked the operations of Fannie Mae with other Democrats who then cooked the books (FM had to pay MILLIONS in fines to the SEC over this) and took HUNDREDS OF MILLIONS OF DOLLARS in bonuses and funneled MILLIONS in campaign contributions to members of Congress. Franklin Raines (part of the Obama Administration) personally took 90 million dollars despite Fannie Mae's fines and fraud. FACT: Bill Clinton turned a blind eye to all of this during most of the 90's. In fact, he worsened the situation in 1995 by making the CRA even more lopsided and requiring even MORE bad loans. One thing he did was to force lending institutions to accept up to 31% of one's income for a mortgage whereas previously it was only 25% FACT: The Democrats who run Fannie Mae took hundreds of millions in bonuses while Congressional Dems provided cover, including Charlie Rangel , Chris Dodd , Barack Obama and Joe Biden. FACT: Democrat Chris Dodd was #1 recipient with Democrat Barack Obama being #2 in campaign contributions from Fannie Mae and Freddy Mac FACT: The Democrats blocked every attempt by Republicans to investigate Fannie Mae and its business practices. In fact, the Bush Administration made over 30 attempts over his two terms in office only to have the Democrats block every one through parliamentary procedures as the Republicans, while controlling both Houses, NEVER had a super majority so the Dems could block anything they pleased (case in point - judicial nominees)  http://query.nytimes.com/gst/fullpag...gewanted=print Quote:

Quote:

Quote:

Quote:

|

|||||||||||

|

|

|

|||||||||||

| The Following User Says Thank You to KenHorse For This Useful Post: |

|

|

#14 | ||||||

|

Vette Barn Crew

Join Date: May 2024

Location: Make Believe Acres is the place to be...

Posts: 143

Thanks: 47

Thanked 68 Times in 41 Posts

Gameroom Barn Bucks: $500

|

|

||||||

|

|

|

||||||

|

|

#15 | |||||||

|

Barn Stall Owner #112

Join Date: Apr 2022

Location: The Blue Ridge Mountains

Posts: 18,082

Thanks: 7,174

Thanked 4,982 Times in 2,929 Posts

Gameroom Barn Bucks: $500

|

Quote:

|

|||||||

|

|

|

|||||||

|

|

#16 | ||||||

|

Barn Stall Owner #123

Join Date: Jul 2011

Location: I live my life by 2 rules. 1) Never share everything you know. 2)

Posts: 2,187

Thanks: 153

Thanked 2,293 Times in 1,037 Posts

Gameroom Barn Bucks: $525

|

|

||||||

|

|

|

||||||

| The Following User Says Thank You to KenHorse For This Useful Post: |

|

|

#17 | ||||||

|

Barn Stall Owner #112

Join Date: Apr 2022

Location: The Blue Ridge Mountains

Posts: 18,082

Thanks: 7,174

Thanked 4,982 Times in 2,929 Posts

Gameroom Barn Bucks: $500

|

|

||||||

|

|

|

||||||

|

|

#18 | |||||||

|

A Real Barner

Join Date: Jan 2011

Location: Green Acres is the place to be...

Posts: 38,940

Thanks: 6,595

Thanked 24,698 Times in 11,220 Posts

Gameroom Barn Bucks: $8122190

|

Quote:

And Ken covered it pretty well. |

|||||||

|

|

|

|||||||

|

|

#19 | ||||||

|

Vette Barn Crew

Join Date: Jan 2024

Location: The Land Of Oz

Posts: 343

Thanks: 0

Thanked 652 Times in 181 Posts

Gameroom Barn Bucks: $500

|

Yep Odumbo was 100% behind the last housing crash, as he was lead attorney on the 175 or so plaintiffs that sued to get loans that they had no business getting, and probably had no intention of paying anyway..........every single damn one of them defaulted on their loans, but by then loans had become politicized and qualifying was gutted, and so you had the crash due to a bunch of greed on both sides lenders, and borrowers........did they not learn a damn thing.......of course Odumbo rode off into the sunset and his role in the housing crash was forgotten, and swept under the rug...

|

||||||

|

|

|

||||||

|

|

#20 | ||||||

|

A Real Barner

Join Date: Jul 2022

Posts: 4,193

Thanks: 649

Thanked 3,928 Times in 1,775 Posts

Gameroom Barn Bucks: $500

|

Yeah - the no-doc (no document loans) from the previous big crash were just ridiculous.

|

||||||

|

|

|

||||||

|

|

|

Support the Barn: |

Download the Mobile App; |

Follow us on Facebook: |

||